How much higher can the stock market climb before the next major correction? We know the market must pull back at some point. The problem is that no one knows when it will happen or how much more the market will grow before the next drop.

Should You Invest When the Market is High?

No one wants to invest at the peak of the market just in time for a major downturn. Everyone knows that “buy low, sell high” is the key to successful investing. Therefore, it is natural for investors to wonder if all-time market highs might not be the best time to buy more stocks.

However, based on historical data, there is no consistent pattern of market declines following all-time highs. In fact, many periods of exceptionally positive returns have followed all-time highs in the market. Unfortunately, many investors miss out on large growth opportunities and fall prey to inflationary losses waiting for the “right time” to invest. We have seen investors wait on the sidelines while the market rose 30%, then they finally felt comfortable investing when it pulled back 5%, still 25% higher than when they originally had the funds to invest.

What does the Data Say on Investing When the Market is High?

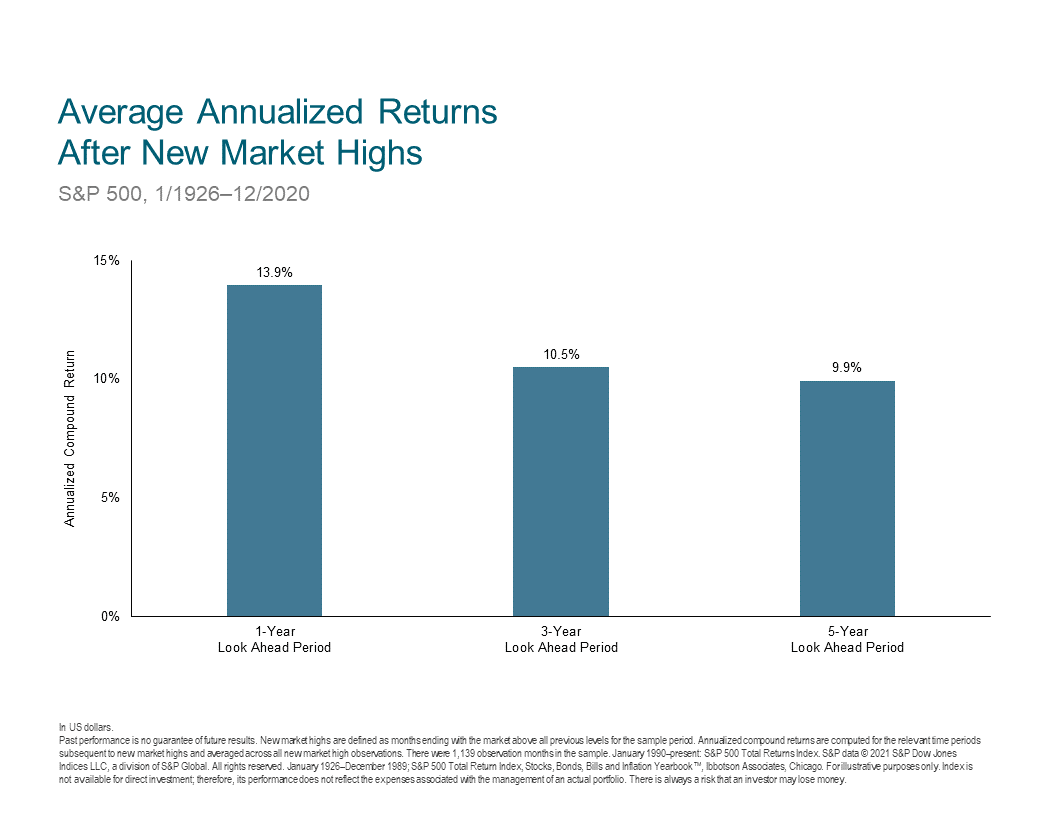

Dimensional Fund Advisors conducted a study of average annual returns following new market highs in the S&P 500 (US large stocks) from January 1926 to December 2020. As you can see in the chart below, they discovered that these 500 stocks returned an average of 13.9% for the next one year, 10.5% for the next three years, and 9.9% for the next five years following all-time highs.

Does Timing Matter When Investing?

It’s all about time in the market, not timing the market. Yes, it can be extremely frustrating to experience a decline in the market right after investing a large sum, but it can be just as frustrating to sit on the sidelines while a steady wave of growth puts you further and further behind. The key is to invest when you have the money and ensure your investments match your purpose and time horizon.

Read more about Capstone Capital’s Investment Philosophy and reach out if you’d like to learn more.

- Should You Invest At the Peak of the Stock Market? - August 5, 2021

- Our Thoughts on Bitcoin: Capstone Capital Wealth Advisors - May 12, 2021

- Are You Over-Insured? - September 12, 2017