Chasing Chances

Read or listen to this compelling book written by our CEO, Adam Dawson. Through unbelievable real-life stories, you will discover the secrets of why many popular investment strategies fail and how to apply proven practices that dramatically increase your chances of success. Available on Amazon and Audible.

For help with implementing the principles discussed in this book, call us at (702) 433-7588 or click the link below.

Audiobook Resources

See below for figures and sources referenced throughout the audiobook, as well as important disclosures.

Figure 1: S&P 500 Historical Prices, Jan-Dec 2020

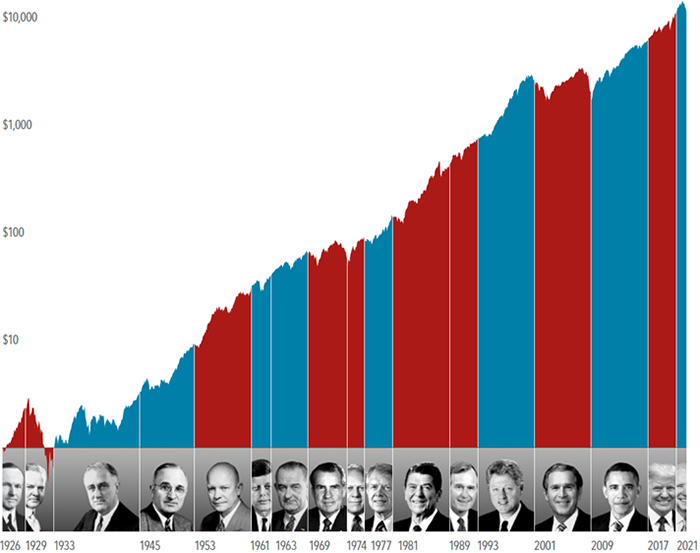

Figure 2: U.S. Presidential Elections & Market Returns

Hypothetical Growth of $1 Invested in S&P 500 Index, January 1, 1926-June 30, 2022

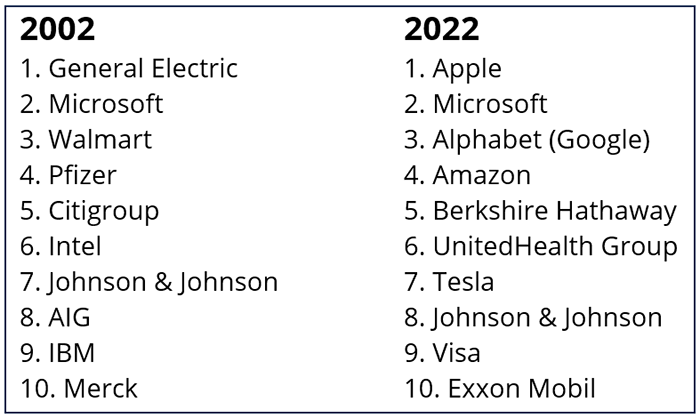

Figure 3: Ten Largest U.S. Companies Then & Now

Figure 4: Twenty Major Company Failures Since 2002

Figure 5: Twenty Iconic Companies Born Since 2002

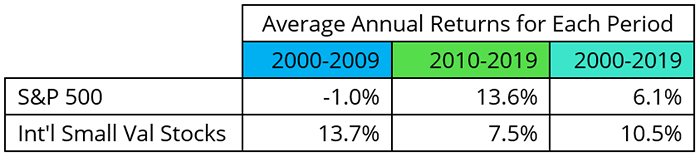

Figure 6: Diversification Lessons from the “Lost Decade”

Figure 7: Stock Returns of Developed Markets

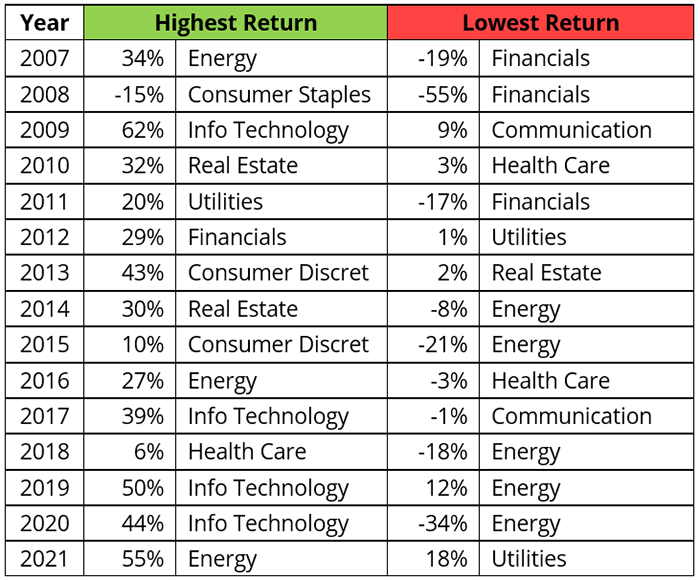

Figure 8: S&P 500 Sector Performance

Figure 9: GameStop closing Prices, Jan 1-Feb 15, 2021

Figure 10: Dow Jones Industrial Average, 1925-1933

Figure 11: Gold Monthly Prices, Jan 1980 to Dec 2022

Figure 12: Silver Monthly Prices, Jan 1980 to Dec 2022

Figure 13: Bitcoin Prices, Jan 2015 to Feb 2023

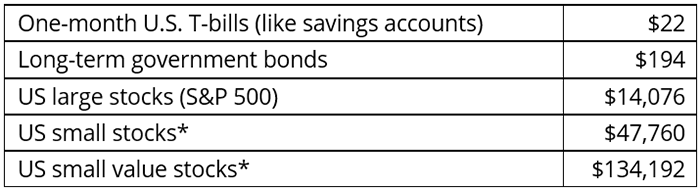

Figure 14: Growth of $1 from 1926 to 2021

*Small stock returns shown from 1928 to 2021. Source: Dimensional Fund Advisors Matrix Book 2022. Past performance is no guarantee of future results.

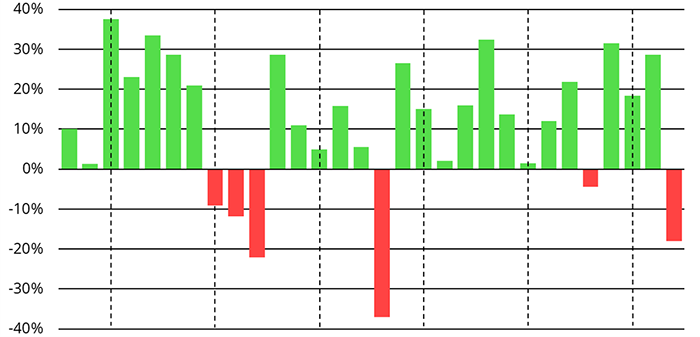

Figure 15: S&P 500 Annual Returns, 1993-2022

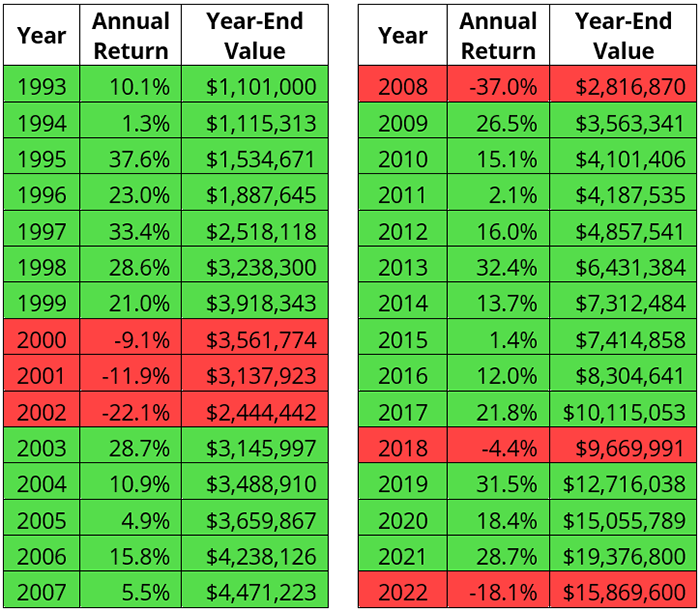

Figure 16: S&P 500 Compounded Annual Returns, 1993-2022, Starting with $1,000,000

Figure 17: Foreign Stocks You Might Want to Own

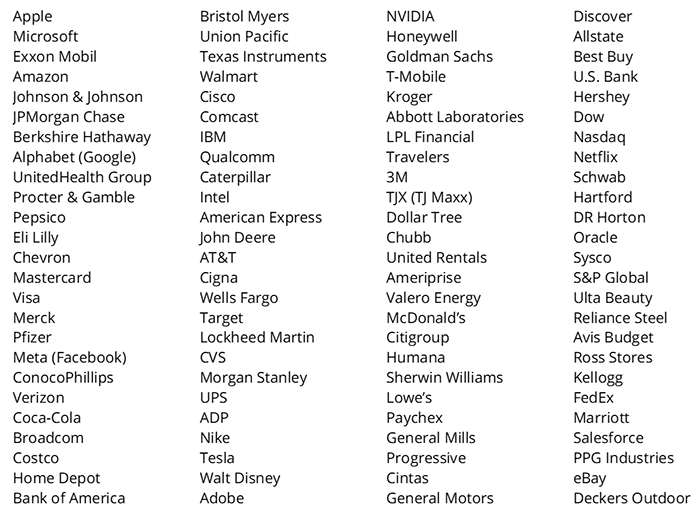

Figure 18: 100 of the Thousands of Stocks Our Clients Own

Audiobook Sources and Disclosures

Introduction

1: Jack Caporal, “Average Retirement Savings in the U.S.: $65,000,” The Motley Fool, updated June 2, 2023, www.fool.com/research/average-retirement-savings.

2: Bob McKenzie, The Hockey News, 1983.

3: Michael Jackson, “They Don’t Care about Us,” HIStory: Past, Present, and Future, Book I (New York: Epic, 1995).

Chapter 1: Timing the Market

2: In U.S. dollars. For illustrative purposes. Best performance dates represent end of period (Nov. 28, 2008, for best week; April 22, 2020, for best month). The missed best consecutive days examples assume that the hypothetical portfolio fully divested its holdings at the end of the day before the missed best consecutive days, held cash for the missed best consecutive days, and reinvested the entire portfolio in the Russell 3000 Index at the end of the missed best consecutive days. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Study conducted by Dimensional Fund Advisors LP, an investment advisor registered with the Securities and Exchange Commission.

3: Based on S&P 500 returns from 2007 to 2017 with dividends reinvested.

4: Iddo Magen, “The Dangers of Zero Gravity,” Weizmann Institute of Science, February 27, 2017, davidson.weizmann.ac.il/en/online/sciencepanorama/dangers-zero-gravity.

5: “Why a Stock Peak Isn’t a Cliff,” Dimensional, December 21, 2021, www.dimensional.com/us-en/insights/why-a-stock-peak-isnt-a-cliff.

6: Brian Dolan, “Santa Claus Rally Definition,” Investopedia, updated December 21, 2022, www.investopedia.com/terms/s/santaclauseffect.asp.

7: Amanda Reaume, “Santa Claus Rally: What Is It, When Can It Occur?” Seeking Alpha, updated November 8, 2022, seekingalpha.com/article/4474942-what-is-santa-claus-rally.

8: James Chen, “Super Bowl Indicator Definition,” Investopedia, updated February 7, 2023, www.investopedia.com/terms/s/superbowlindicator.asp.

9: Larry Swedroe, “Harry Dent and the Chamber of Poor Returns,” CBS News MarketWatch, August 19, 2013, www.cbsnews.com/news/harry-dent-and-the-chamber-of-poor-returns.

10: Kevin Stankiewicz, “Here’s Our Rapid-Fire Update on all 34 Stocks in Jim Cramer’s Charitable Trust Portfolio,” CNBC, October 13, 2022, www.cnbc.com/2022/10/13/october-rapid-fire-update-on-all-34-stocks-in-cramers-portfolio.html.

11: Murray Coleman, “Jim Cramer vs. S&P 500: Chasing ‘Mad Money,’” Index Fund Advisors, updated November 29, 2021, www.ifa.com/articles/cramer_chasing_mad_money.

12: Steven Goldberg, “Jim Cramer’s Stock Picks Stink,” Kiplinger, updated May 18, 2016, www.kiplinger.com/article/investing/t052-c007-s001-jim-cramer-s-stock-picks-stink.html.

13: “Loss Aversion,” BehavoiralEconomics.com, accessed June 20, 2023, www.behavioraleconomics.com/resources/mini-encyclopedia-of-be/loss-aversion/.

14: Adam Shell, “Dow Ends Wild Day Down 1,175 Points, Largest Point Drop In History,” USA Today, February 5, 2018, www.usatoday.com/story/money/2018/02/05/dow-falls-300-points-open-extending-declines-last-week/306400002/.

15: List of largest daily changes in the Dow Jones Industrial Average,” Wikipedia, accessed June 19, 2023, en.wikipedia.org/wiki/List_of_largest_daily_changes_in_the_Dow_Jones_Industrial_Average.

16: “Dot-com Bubble,” Wikipedia, accessed June 22, 2023, https://en.wikipedia.org/wiki/Dot-com_bubble.

17: “Great Recession, Great Recovery? Trends from the Current Population Survey,” Monthly Labor Review, April, 2018, https://www.bls.gov/opub/mlr/2018/article/great-recession-great-recovery.htm.

18: Ian Webster, “Stock Market Returns Between 2000 and 2022,” S&P 500 Data, accessed June 22, 2023, www.officialdata.org/us/stocks/s-p-500/2000?amount=1000000&endYear=2022. Past performance is no guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. In U.S. dollars. For illustrative purposes only.

19: Leslie Kramer, “What Caused the Stock Market Crash of 1929 and the Great Depression?” Investopedia, updated June 14, 2023, https://www.investopedia.com/ask/answers/042115/what-caused-stock-market-crash-1929-preceded-great-depression.asp.

20: Lizzie Wade, “From Black Death to Fatal Flu, Past Pandemics Show Why People on the Margins Suffer Most,” Science, May 14, 2020, www.science.org/content/article/black-death-fatal-flu-past-pandemics-show-why-people-margins-suffer-most.

21: “How Much Impact Does the President Have on Stocks?” Dimensional, November 3, 2022, www.dimensional.com/us-en/insights/how-much-impact-does-the-president-have-on-stocks. Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. In US dollars. Growth of wealth shows the growth of a hypothetical investment of $1 in the securities in the S&P 500 Index. S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Data presented in the growth of wealth chart is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

22: “Do Markets Care Who Runs Congress?” Dimensional, October 25, 2022, www.dimensional.com/us-en/insights/do-markets-care-who-runs-congress.

Chapter 2: Picking Stocks

1: Wes Crill, “Myth-Busting with Momentum: How to Pursue the Premium,” Dimensional, November 5, 2021,

www.dimensional.com/us-en/insights/myth-busting-with-momentum-how-to-pursue-the-premium.

2: Adam Hayes, “Recency (Availability) Bias,” Investopedia, November 29, 2022, www.investopedia.com/recency-availability-bias-5206686.

3: Larry Swedroe, “The Impact of Recency Bias on Equity Markets,” The Evidence-Based Investor, June 25, 2021, www.evidenceinvestor.com/the-impact-of-recency-bias-on-equity-markets/.

4: Wes Crill, “Have the Tech Giants Been DeFAANGed?” Dimensional, June 10, 2022, www.dimensional.com/us-en/insights/have-the-tech-giants-been-defaanged.

5: “Largest American Companies by Market Capitalization,” CompaniesMarketCap.com, accessed June 19, 2023, companiesmarketcap.com/usa/largest-companies-in-the-usa-by-market-cap/.

6: “Market Capitalization of General Electric (GE),” CompaniesMarketCap.com, accessed June 19, 2023, companiesmarketcap.com/general-electric/marketcap/;

“Market Capitalization of Apple (AAPL),” accessed June 19, 2023, companiesmarketcap.com/apple/marketcap/.

7: Wes Crill, “FAANGs Gone Value,” Dimensional, August 25 2022, www.dimensional.com/us-en/insights/faangs-gone-value.

8: Maggie McGrath, “Target Profit Falls 46% on Credit Card Breach and the Hits Could Keep on Coming,” Forbes, February 26, 2014, www.forbes.com/sites/maggiemcgrath/2014/02/26/target-profit-falls-46-on-credit-card-breach-and-says-the-hits-could-keep-on-coming/?sh=12c664c97326.

9: “The Post-Enron 401(k), Forbes, October 20, 2003, www.forbes.com/2003/10/20/cx_aw_1020retirement.html?sh=51457c4b2824;

“What Enron Employees Have Lost,” NPR, January 22, 2002, legacy.npr.org/news/specials/enron/employees.html.

10: “Tesla—Stock Split History,” Macrotrends, accessed June 19, 2023, www.macrotrends.net/stocks/charts/TSLA/tesla/stock-splits.

11: James Chen, “What Is Hindsight Bias?” Investopedia, September 29, 2022, www.investopedia.com/terms/h/hindsight-bias.asp.

12: “Fear of Flying,” Anxieties.com, accessed June 19, 2023, https://anxieties.com/self-help-resources/fear-of-flying.

13: “The Data on Day Trading,” CurrentMarketValuation.com, February 21, 2023, https://www.currentmarketvaluation.com/posts/the-data-on-day-trading.php.

14: Michael Mayhew, “Buy-Side Spending on Investment Research Expected to Fall in 2021,” Integrity Research Associates,

July 5, 2021, www.integrity-research.com/buy-side-spending-on-investment-research-expected-to-fall-in-2021/.

15: Scott Powell, “Equity Research Overview,” CFI, updated May 31, 2023, corporatefinanceinstitute.com/resources/career/equity-research-overview/.

16: “Entrepreneurship and the U.S. Economy,” U.S. Bureau of Labor Statistics, updated April 28, 2016, www.bls.gov/bdm/entrepreneurship/entrepreneurship.htm.

17: Vijay Govindarajan and Anup Srivastava, “The Scary Truth About Corporate Survival,” Harvard Business Review,

December 2016, hbr.org/2016/12/the-scary-truth-about-corporate-survival.

Chapter 3: Chasing What’s Hot

2: “Morgan Stanley Inst Discovery,” Morningstar.com, accessed June 19, 2023,

www.morningstar.com/funds/xnas/mpegx/performance.

3: John Coumarianos, “The Best and Worst Funds of 2020,” Citywire, December 22, 2020, citywire.com/pro-buyer/news/the-best-and-worst-funds-of-2020/a1442624.

4: “NexPoint Climate Tech Y,” Morningstar.com, accessed June 19, 2023, www.morningstar.com/funds/xnas/hszyx/performance.

5: “The Fund Landscape 2022,” Dimensional, www.ifa.com/pdfs/the-fund-landscape-dfa.pdf.

6: “Dimensional vs. the Industry” as of December 31, 2022. Performance data shown represents past performance and is no guarantee of future results. The sample includes funds at the beginning of each respective period. Survivors are funds that had returns for every month in the sample period. Outperformers (winner funds) are funds that survived the sample period and whose cumulative net return over the period exceeded that of their respective benchmark. Each fund is evaluated relative to its respective primary prospectus benchmark. Where the full series of primary prospectus benchmark returns is unavailable, funds are instead evaluated relative to their Morningstar category index. Dimensional fund data provided by the fund accountant. Dimensional funds or sub-advised funds whose access is or previously was limited to certain investors are excluded. US-domiciled, USD-denominated open-end and exchange-traded fund data is provided by Morningstar. Mutual fund investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost. Diversification neither assures a profit nor guarantees against a loss in a declining market. There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. ETFs trade like stocks, fluctuate in market value, and may trade either at a premium or a discount to their net asset value. ETF shares trade at market price and are not individually redeemable with the issuing fund, other than in large share amounts called creation units. ETFs are subject to risks similar to those of stocks, including those regarding short-selling and margin account maintenance. Brokerage commissions and expenses will reduce returns.

7: “A Tale of Two Decades: Lessons for Long‑Term Investors,” Dimensional, January 2020, chapters.onefpa.org/greaterindiana/wp-content/uploads/sites/17/2020/02/Dimensional-article-February-2020.pdf.

There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Investors should talk to their financial advisor prior to making any investment decision. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss.

8: “Which Country Will Outperform? Here’s Why It Shouldn’t Matter,” Dimensional, January 17, 2023, www.dimensional.com/us-en/insights/which-country-will-outperform-heres-why-it-shouldnt-matter. In U.S. dollars. MSCI country indices (net dividends) for each country listed. Does not include Israel, which MSCI classified as an emerging market prior to May 2010.

9: “An unprecedented 168 mutual funds returned more than 100% in 1999,” Pensions&Investments, January 13, 2000, www.pionline.com/article/20000113/ONLINE/1130707/an-unprecedented-168-mutual-funds-returned-more-than-100-in-1999.

10: Aaron Lucchetti, “Nicholas-Applegate to Lay Off Some Staff, Close Tech Fund,” The Wall Street Journal, October 3, 2002, www.wsj.com/articles/SB1033601019201729673.

11: “Zoom Video Communications Inc (ZM),” YCharts, accessed June 19, 2023, ycharts.com/companies/ZM/performance/price; “Apple Inc (AAPL),” YCharts, accessed June 19, 2023, ycharts.com/companies/AAPL/performance/price; “Amazon.com Inc (AMZN),” YCharts, accessed June 19, 2023, ycharts.com/companies/AMZN/performance/price.

12: “Annual S&P Sector Performance,” Novel Investor, accessed June 19, 2023, novelinvestor.com/sector-performance/.

13: “IPOs: Profiles Are High. What About Returns?” Dimensional, August 1, 2019, www.dimensional.com/us-en/insights/ipos-profiles-are-high-what-about-returns

14: Dominic Rushe, “Facebook IPO: Five Things That Went Wrong With the Social Network’s Debut,” The Guardian, May 24, 3012, www.theguardian.com/technology/2012/may/24/facebook-ipo-mark-zuckerberg-nasdaq.

15: Smita Nair, “Why did Facebook’s Shares Fall After Its Initial Public Offering?” Yahoo!News, January 14, 2014, news.yahoo.com/why-did-facebook-shares-fall-225006922.html.

16: Snap Inc.,” Yahoo!Finance, accessed June 20, 2023, finance.yahoo.com/quote/SNAP/history?period1=1488412800&period2=1514678400&interval=1d&filter=history&frequency=1d&includeAdjustedClose=true.

17: “Snap Inc.,” YCharts, accessed June 20, 2023, https://ycharts.com/companies/SNAP/performance/price

18: “Spotify Technology – Stock Split History | SPOT,” Macrotrends, accessed June 20, 2023, www.macrotrends.net/stocks/charts/SPOT/spotify-technology/stock-splits; “Spotify Technology,” Yahoo!Finance, accessed June 20, 2023,

finance.yahoo.com/quote/SPOT/history?period1=1522713600&period2=1671753600&interval=1d&filter=history&frequency=1d&includeAdjustedClose=true.

19: “GameStop – Stock Split History | GME,” Macrotrends, accessed June 20, 2023, www.macrotrends.net/stocks/charts/GME/gamestop/stock-splits.

20: Alexander Jones, “GameStop: One Year Since Retail Investors Took on Wall Street,” International Banker, February 23, 2022, internationalbanker.com/brokerage/gamestop-one-year-since-retail-investors-took-on-wall-street/.

21: Adam Hayes, “What Are Meme Stocks, and Are They Real Investments?” Investopedia, September 12, 2022, www.investopedia.com/meme-stock-5206762.

22: Leslie Kramer, “The Stock Market Crash of 1929 and the Great Depression,” June 4, 2023, www.investopedia.com/ask/answers/042115/what-caused-stock-market-crash-1929-preceded-great-depression.asp.

23: Mark Hulbert, “25 Years to Bounce Back from the 1929 Crash? Try Four-and-a-Half,” New York Times, April 26, 2009, www.livemint.com/Money/Oww1BVK1roWvXRUCd0VjIJ/25-years-to-bounce-back-from-the-1929-crash-Try-fouranda.html.

24: “Stock Market Crash of 1929,” Federal Reserve History, November 22, 2013, www.federalreservehistory.org/essays/stock-market-crash-of-1929; “Stock Market Crash of 1929,”Britinnanica, updated March 27, 2023, www.britannica.com/event/stock-market-crash-of-1929; A Brief History of the 1929 Stock Market Crash, April 8, 2018, www.businessinsider.com/the-stock-market-crash-of-1929-what-you-need-to-know-2018-4.

25: “Updated Investor Bulletin: Leveraged and Inverse ETFs,” U.S. Securities and Exchange Commission, February 23, 2023, www.sec.gov/investor/pubs/leveragedetfs-alert.

26: “Status of Washington Mutual Bank Receivership,” FDIC, updated October 23, 2020, www.fdic.gov/resources/resolutions/bank-failures/failed-bank-list/wamu-settlement.html.

27: Jason Zweig, “An Iowa Farmer Tried to Dodge Stock-Market Turmoil. It Cost Him $900,000,” The Wall Street Journal, January 13, 2023, www.wsj.com/articles/regulation-d-private-offering-debt-equity-11673625595?st=1hc5230hccalfnn&reflink=desktopwebshare_permalink.

28: Thomas Kenny, “Historical Performance Data of High-Yield Bonds,” The Balance, October 24, 2022, www.thebalancemoney.com/high-yield-bonds-historical-performance-data-417116.

29: Alex Crippin, “Transcript & Video: Ask Warren Buffett on CNBC’s Squawk Box—Part 7,” CNBC, updated September 13, 2013, www.cnbc.com/2009/03/09/transcript-video-ask-warren-buffett-on-cnbcs-squawk-box-part-7.html.

30: “Buffett on Gold,” Gregg Turk Foundation, accessed June 21, 2023, www.gturk.org/buffet-on-gold.

31: Matt DiLallo, “Why Warren Buffett Hates Gold,” USA Today, September 21, 2014, www.usatoday.com/story/money/2014/09/21/why-warren-buffett-hates-gold/15909821/.

32: “Gold Prices 1792-1973,” Maguire Refining, accessed June 21, 2023, www.maguireref.com/wp-content/uploads/2012/03/GoldPricesChart.pdf.

33: Mark Hulbert, “25 Years to Bounce Back from the 1929 Crash? Try Four-and-a-Half,” New York Times, April 26 2009, www.livemint.com/Money/Oww1BVK1roWvXRUCd0VjIJ/25-years-to-bounce-back-from-the-1929-crash-Try-fouranda.html.

34: “Gold Prices—100 Year Historical Chart,” Macrotrends, accessed June 21, 2023, www.macrotrends.net/1333/historical-gold-prices-100-year-chart.

35: “Price of Gold 2011,” SD Bullion, accessed June 21, 2023, sdbullion.com/gold-prices-2011.

36: “Price of Gold in 2015,” SD Bullion, accessed June 21, 2023, sdbullion.com/gold-prices-2015.

37: “Price of Gold in 2020,” SD Bullion, accessed June 21, 2023, sdbullion.com/gold-prices-2020.

38: “Stock Market Returns Between 1980 and 2022,” S&P 500 Data, accessed June 21, 2023, www.officialdata.org/us/stocks/s-p-500/1980?amount=1000000&endYear=2022.

39: “What Is the History of the S&P 500 Stock Index?” Investopedia, updated April 13, 2023, www.investopedia.com/ask/answers/041015/what-history-sp-500.asp.

40: The Royal Mint, accessed June 21, 2023, www.royalmint.com/invest/discover-more/storage-fees/.

41: Jeff Reeves, “Beware Gold’s Hidden Costs,” The Street, September 25, 2010, www.thestreet.com/opinion/beware-golds-hidden-costs-10871461; Bob Frick, “7 Ways Not to Buy Gold,” Kiplinger, March 2, 2011, www.kiplinger.com/article/spending/t026-c011-s001-7-ways-not-to-buy-gold.html

42: “Customer Advisory: Beware of Gold and Silver Schemes Designed to Drain Your Retirement Savings,” Commodity Futures Trading Commission, accessed June 21, 2023, www.cftc.gov/LearnAndProtect/AdvisoriesAndArticles/CustomerAdvisory_COVID19PreciousMetals.htm.

43: “Silver Prices—100 Year Historical Chart,” Macrotrends, accessed June 21, 2023, www.macrotrends.net/1470/historical-silver-prices-100-year-chart; “Platinum Prices—Interactive Historical Chart,” Macrotrends, accessed June 21, 2023, www.macrotrends.net/2540/platinum-prices-historical-chart-data.

44: Napoleon Hill, Think and Grow Rich (New York: Random House, 1996), 22.

45: Les Christie, “Foreclosures up 75 percent in 2007,” CNN Money, January 29, 2008, money.cnn.com/2008/01/29/real_estate/foreclosure_filings_2007/.

46: Joel Kurth and Christine MacDonald, The Detroit News, June 24, 2015, www.detroitnews.com/story/news/special-reports/2015/05/14/detroit-abandoned-homes-volume-terrifying/27237787/.

47: Louis Aguilar, “Detroit’s Housing Market Has Been Broken Since 2006, Study Says,” BridgeDetroit, April 15, 2021, www.bridgedetroit.com/detroits-housing-market-has-been-broken-since-2006-study-says/.

48: Adam Millsap, “What The Boom And Bust Of Williston, North Dakota Teaches Us About The Future Of Cities,” Forbes, June 7, 2016, www.forbes.com/sites/adammillsap/2016/06/07/williston-nd-and-the-rise-and-fall-of-american-cities/?sh=3893e9c23cf3.

49: Hannah Sparks, “Infamous Bitcoin Pizza Guy Who Squandered $365M Haul Has No Regrets,” New York Post, May 2021, 24, nypost.com/2021/05/24/bitcoin-pizza-guy-who-squandered-365m-has-no-regrets/; “Bitcoin USD,” Yahoo!Finance, accessed June 21, 2023, finance.yahoo.com/quote/BTC-USD/history/.

50: Wayne Duggan, “The History of Bitcoin, the First Cryptocurrency,” US News & World Report, May 10, 2023, money.usnews.com/investing/articles/the-history-of-bitcoin.

51: “What is Bitcoin?” Coinbase, accessed June 21, 2023, www.coinbase.com/learn/crypto-basics/what-is-bitcoin.

52: Samyuktha Sriram, “Bitcoin Becomes Best Performing Asset of The Decade, Returning Ten Times More Than Nasdaq 100,” Yahoo!, March 16, 2021, www.yahoo.com/video/bitcoin-becomes-best-performing-asset-132208120.html.

53: “Bitcoin,” CoinMarketCap, accessed June 21, 2023, coinmarketcap.com/currencies/bitcoin/.

54: “Bitcoin,” CoinDesk, accessed June 21, 2023, www.coindesk.com/price/bitcoin/.

55: “What Really Happened to LUNA Crypto?” Forbes Digital Assets, September 20, 2022, www.forbes.com/sites/qai/2022/09/20/what-really-happened-to-luna-crypto/?sh=1261d2a74ff1.

56: Bill Chappell, David Gura, Lisa Lambert, “Bankman-Fried is Arrested as Feds Charge Massive Fraud at FTX Crypto Exchange,” December 13, 2022, www.npr.org/2022/12/12/1142361088/bankman-fried-ceo-ftx-crypto-exchange-arrested-bahamas-charges-sdny.

57: Brian Nibley, “Tracking Down Lost Bitcoins and Other Cryptos,” SoFi Learn, September 13, 2022, www.sofi.com/learn/content/how-to-find-lost-bitcoin/.

58: “Securities and Exchange Commission v. Matthew Wade Beasley et al.,” United States District Court, District of Nevada, accessed June 21, 2023, www.sec.gov/litigation/complaints/2022/comp25434.pdf.

59: “J&J Purchasing: When It Sounds Too Good to Be True,” Hindenburg Research, March 24, 2022, hindenburgresearch.com/jj-purchasing/.

60: “Affinity Fraud: How to Avoid Investment Scams That Target Group,” U.S. Securities and Exchange Commission, October 9, 2013, www.sec.gov/investor/pubs/affinity.

61: “Bernie Madoff,” Britannica, updated April 25, 2023; Adam Hayes, Bernie Madoff: Who He Was, How His Ponzi Scheme Worked,” Investopedia, updated March 29, 2023, www.investopedia.com/terms/b/bernard-madoff.asp; Marty Steinberg and Scott Cohn, “Bernie Madoff, Mastermind of the Nation’s Biggest Investment Fraud, Dies at 82,” April 14, 2021, www.cnbc.com/2021/04/14/bernie-madoff-dies-mastermind-of-the-nations-biggest-investment-fraud-was-82.html

Chapter 4: Going Broke Safely

2: Beth Mallory, “Horse Riding Accident Statistics in 2023 (Latest U.S. Data),” HorsesOnly, updated May 17, 2023, horsesonly.com/horse-riding-accidents/.

3: Maryalene LaPonsie, “How Living Longer Will Impact Your Retirement,” US News & World Report, April, 22 2020, money.usnews.com/money/retirement/articles/how-living-longer-will-impact-your-retirement.

4: Jean Eaglesham, “Wall Street Re-Engineers the CD—and Returns Suffer,” The Wall Street Journal, September 6, 2016, www.wsj.com/articles/wall-street-re-engineers-the-cdand-returns-suffer-1473180591?reflink=desktopwebshare_permalink.

5: www.cantella.com/regbidocs/Investors%20Guide%20to%20Structured%20Products.pdf

6: Jim Probasco, “6 Reasons to Beware of Market-Linked CDs,” Investopedia, August 21, 2021, www.investopedia.com/articles/investing/092316/6-reasons-beware-marketlinked-cds.asp; “Equity Linked CDs,” U.S. Securities and Exchange Commission, updated October 12, 2006, www.sec.gov/answers/equitylinkedcds.htm.

7: Aye Soe, “S&P 500 Dividend Aristocrats: The Importance of Stable Dividend Income,” S&P Dow Jones Indices, September 23, 2021, www.spglobal.com/spdji/en/research/article/a-fundamental-look-at-sp-500-dividend-aristocrats/.

8: Jean Eaglesham, “Wall Street Re-Engineers the CD—and Returns Suffer,” The Wall Street Journal, September 6, 2016, www.wsj.com/articles/wall-street-re-engineers-the-cdand-returns-suffer-1473180591.

9: “SEC, FINRA Warn Retail Investors About Investing in Structured Notes with Principal Protection,” U.S. Securities and Exchange Commission, updated June 2, 2011, www.sec.gov/news/press/2011/2011-118.htm

10: “The Complicated Risks and Rewards of Indexed Annuities,” FINRA, July 14, 2022, www.finra.org/investors/insights/complicated-risks-and-rewards-indexed-annuities; “Updated Investor Bulletin: Indexed Annuities,” Investor.gov, July 31, 2020, www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/investor-bulletins/updated-13.

Chapter 5: Ignoring Costs

1 “The House Edge and Its Effect,” GamblingSites.com, updated April 2023, www.gamblingsites.org/casino/beginners-guide/house-edge/

2 Mark Maremont and Alexandra Berzon, “How Often Do Gamblers Really Win?” The Wall Street Journal, October 11, 2013, www.wsj.com/articles/how-often-do-gamblers-really-win-1381514164.

3 Rob Wile, “Back in The Day, Brokers Got Away with Murder In Trading Commissions,” Business Insider, March 31, 2014, www.businessinsider.com/historical-trading-commissions-2014-3.

4 John Divine, “How Robinhood Changed an Industry,” US News & World Report, October 17, 2019, money.usnews.com/investing/investing-101/articles/how-robinhood-changed-an-industry.

5 John Detrixhe, “Charles Schwab is cutting brokerage fees to zero, but that doesn’t mean it’s free,” Quartz, October 1, 2019, qz.com/1719659/charles-schwabs-zero-fee-commissions-still-have-costs.

6 Ken Little, “Understanding Bid and Ask Prices in Trading,” The Balance, June 30, 2021, www.thebalancemoney.com/understanding-bid-and-ask-prices-3141317.; Akhilesh Ganti, “What Is a Bid-Ask Spread, and How Does It Work in Trading?” Investopedia, May 31, 2022, www.investopedia.com/terms/b/bid-askspread.asp.

7 “Ally Invest,” Ally, accessed June 20, 2023, www.ally.com/invest/robo-automated-investing/.

8 Alexandra Twin, “There Ain’t No Such Thing as a Free Lunch: Meaning and Examples,” Investopedia, December 23, 2022, www.investopedia.com/terms/t/tanstaafl.asp.

9 Mansoor Iqbal, “Fortnite Usage and Revenue Statistics (2023),” Business of Apps, January 9, 2023, www.businessofapps.com/data/fortnite-statistics/.

10 Suzette Gomez, “Signs Of Gambling Addiction In Robinhood App,” Addiction Center, February 2, 2021, www.addictioncenter.com/news/2021/02/gambling-addiction-robinhood-app/.

11 “Robinhood’s Slow Demise,” SeekingAlpha.com, May 2, 2022, seekingalpha.com/article/4505714-robinhoods-hood-stock-slow-demise.

12 “SEC Charges Robinhood Financial With Misleading Customers About Revenue Sources and Failing to Satisfy Duty of Best Execution,” U.S. Securities and Exchange Commission, December 17, 2020,www.sec.gov/news/press-release/2020-321.

13 Matt Egan, “Robinhood Settles Lawsuit Over 20-Year-Old Trader Who Died by Suicide,” CNN Business, July 1, 2021, abc7news.com/robinhood-settles-lawsuit-alex-kearns-stocks-settlement/10851075/.

14 George Glover, “Fewer Retail Investors Are Trading Stocks and Cryptocurrencies on Robinhood as Markets Suffer a Sell-off,” Business Insider, August 3, 2022, markets.businessinsider.com/news/stocks/job-cuts-resignation-robinhood-retail-investing-stocks-cryptocurrencies-vlad-tenev-2022-8#; Annie Massa and Mathieu Benhamou, “Robinhood Gave Its Customers Access to IPOs That All Flopped,” Bloomberg, November 8, 2022, www.bloomberg.com/news/articles/2022-11-08/robinhood-gave-its-customers-access-to-ipos-that-all-flopped?leadSource=uverify percent20wall.

15 Oscar Gonzalez, “Robinhood Sued for Wrongful Death After Young Trader’s Suicide,” CNET, February 8, 2021, www.cnet.com/tech/mobile/robinhood-sued-for-wrongful-death-after-young-traders-suicide/.

16 “Mutual Fund and ETF Turnover Ratio,” Personal Fund, accessed June 20, 2023, personalfund.com/mutual-fund-and-etf-turnover-ratio/.

17 “Stock market returns between 2003 and 2022,”S&P 500 Data, accessed June 20, 2023, www.officialdata.org/us/stocks/s-p-500/2003?amount=1000000&endYear=2022.

18 Pacome Breton, “Harnessing the Power of Long-Term Investing,” Nutmeg, August 18, 2022, www.nutmeg.com/nutmegonomics/increasing-your-chances-of-positive-portfolio-returns-the-facts-about-long-term-investing/.

19 “Time, Not Timing, Is What Matters,” Capital Group, accessed June 20, 2023, www.capitalgroup.com/individual/planning/investing-fundamentals/time-not-timing-is-what-matters.html.

20 Anna-Louise Jackson, “This Chart Shows the Secret to Never Losing Money in the Stock Market,” May 5, 2021, money.com/stock-market-chart-rolling-returns/; “U.S. Stock Market Returns—a History from the 1870s to 2022,” January 5, 2023, themeasureofaplan.com/us-stock-market-returns-1870s-to-present/.

Chapter 6: Disregarding Disclosures

1: “Securities and Exchange Commission vs. Matthew Wade Beasley et al., United States District Court, District of Nevada,” June 29, 2022, www.sec.gov/litigation/complaints/2022/comp25434.pdf.

2: “Consumer Handbook on Adjustable-Rate Mortgages,” The Federal Reserve Board, accessed June 20, 2023, files.consumerfinance.gov/f/201204_CFPB_ARMs-brochure.pdf.

3: “Countrywide Financial: The Subprime Meltdown,” Center for Ethical Organizational Cultures Auburn University, accessed June 20, 2023, harbert.auburn.edu/binaries/documents/center-for-ethical-organizational-cultures/cases/countrywide.pdf.

4: Julia Kagan, “Option Adjustable-Rate Mortgage (Option ARM),” Investopedia, October 12, 2021, www.investopedia.com/terms/o/option_arm.asp.

Chapter 7: Harnessing the Power of the Market

1: “Wind,” Center for Science for Education, “Wind,” accessed June 20, 2023, scied.ucar.edu/learning-zone/how-weather-works/wind.

2: Ethan Shaw, “List Three Factors That Affect Wind Direction,” Sciencing, November 22, 2019, sciencing.com/list-factors-affect-wind-direction-7420202.html

3: Pacome Breton, “Harnessing the Power of Long-Term Investing,” Nutmeg, August 18, 2022 www.nutmeg.com/nutmegonomics/increasing-your-chances-of-positive-portfolio-returns-the-facts-about-long-term-investing/

4: “Largest Companies by Market Cap,” accessed June 20, 2023, companiesmarketcap.com/.

5: Sean Williams, “If You Invested $10,000 In Apple for Its IPO In 1980, Here’s How Much You’d Have Now,” The Motley Fool, October 12, 2022, www.fool.com/investing/2022/10/12/invested-10000-in-apple-ipo-in-1980-how-much-now/;.“Apple, Inc. (AAPL) Yearly Returns, 1Stock1.com, accessed June 20, 2023, www.1stock1.com/1stock1_148.htm.

6: “The Future of Investing,” Dimensional, accessed June 20, 2023, static1.squarespace.com/static/5a29de13e5dd5b5fb7021e6c/t/62870fac4a7f90402dc03313/1653018551921/us_matrix-book-2022.pdf.

7: “Stephen R. Covey,” GoodReads, accessed June 20, 2023, www.goodreads.com/quotes/7378445-think-about-taking-a-trip-on-an-airplane-before-taking.

8: “Do Skyscrapers Sway?” Skydeck, accessed June 20, 2023, theskydeck.com/do-skyscrapers-sway/.

9: Terry Gross, interview with Kate Ascher, “How the World’s Tallest Skyscrapers Work,” Fresh Air, NPR, November 7, 2011, podcast, www.npr.org/transcripts/141858484.

10: Steven Beslic, “LeBron Has Never Posted His Career Average in a Single Regular-Season Game,” Basketball Network, February 8, 2021, www.basketballnetwork.net/latest-news/lebron-has-never-posted-his-career-average-in-a-single-regular-season-game; “LeBron James,” Statmuse, accessed June 20, 2023, www.statmuse.com/nba/player/lebron-james-1780.

11: “Stock Market Returns Between 1993 and 2022,” S&P 500 Data, accessed June 20, 2023, www.officialdata.org/us/stocks/s-p-500/1993?amount=100&endYear=2022.

12: “S&P 500 Total Returns,” Slickcharts, accessed June 20, 2023, www.slickcharts.com/sp500/returns.

13: Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. In U.S. dollars. S&P data ©2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Data presented is hypothetical and assumes reinvestment of income and no transaction costs or taxes.

14: Percent of world market capitalization as of December 31, 2021. Information provided by Dimensional Fund Advisors LP. Market cap data is free-float adjusted and meets minimum liquidity and listing requirements. Dimensional makes case-by-case determinations about the suitability of investing in each emerging market, making considerations that include local market accessibility, government stability, and property rights before making investments. China A-shares that are available for foreign investors through the Hong Kong Stock Connect program are included in China. 30 percent foreign ownership limit and 25 percent inclusion factor are applied to China A-shares. For educational purposes; should not be used as investment advice. Data provided by Bloomberg. Diversification neither assures a profit nor guarantees against loss in a declining market.

15: “Dimensional vs. the Industry” as of December 31, 2022. Performance data shown represents past performance and is no guarantee of future results. The sample includes funds at the beginning of each respective period. Survivors are funds that had returns for every month in the sample period. Outperformers (winner funds) are funds that survived the sample period and whose cumulative net return over the period exceeded that of their respective benchmark. Each fund is evaluated relative to its respective primary prospectus benchmark. Where the full series of primary prospectus benchmark returns is unavailable, funds are instead evaluated relative to their Morningstar category index. Dimensional fund data provided by the fund accountant. Dimensional funds or sub-advised funds whose access is or previously was limited to certain investors are excluded. US-domiciled, USD-denominated open-end and exchange-traded fund data is provided by Morningstar. Mutual fund investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost. Diversification neither assures a profit nor guarantees against a loss in a declining market. There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. ETFs trade like stocks, fluctuate in market value, and may trade either at a premium or a discount to their net asset value. ETF shares trade at market price and are not individually redeemable with the issuing fund, other than in large share amounts called creation units. ETFs are subject to risks similar to those of stocks, including those regarding short-selling and margin account maintenance. Brokerage commissions and expenses will reduce returns.

16: Aditya Rayaprolu, “How Much Data Is Created Every Day in 2023?” Techjury, updated February 27, 2023, techjury.net/blog/how-much-data-is-created-every-day/#gref.

17: Review of Simple Wealth, Inevitable Wealth, Novel Investor, accessed June 20, 2023, novelinvestor.com/notes/simple-wealth-inevitable-wealth-by-nick-murray/.

18: Ronald Bailey and Marian L. Tupy, Ten Global Trends Every Smart Person Should Know, And Many Others You Will Find Interesting (Washington, D.C.: Cato Institute, 2020).

19: Avinash, “Everything Is Amazing and Nobody is Happy: Louis C.K.,” The Educationist, July 14, 2014, www.theeducationist.info/everything-amazing-nobody-happy/.

20: Hans Rosling, Factfulness: Ten Reasons We’re Wrong About the World—and Why Things Are Better Than You Think (New York: Flatiron Books, 2018), 69.